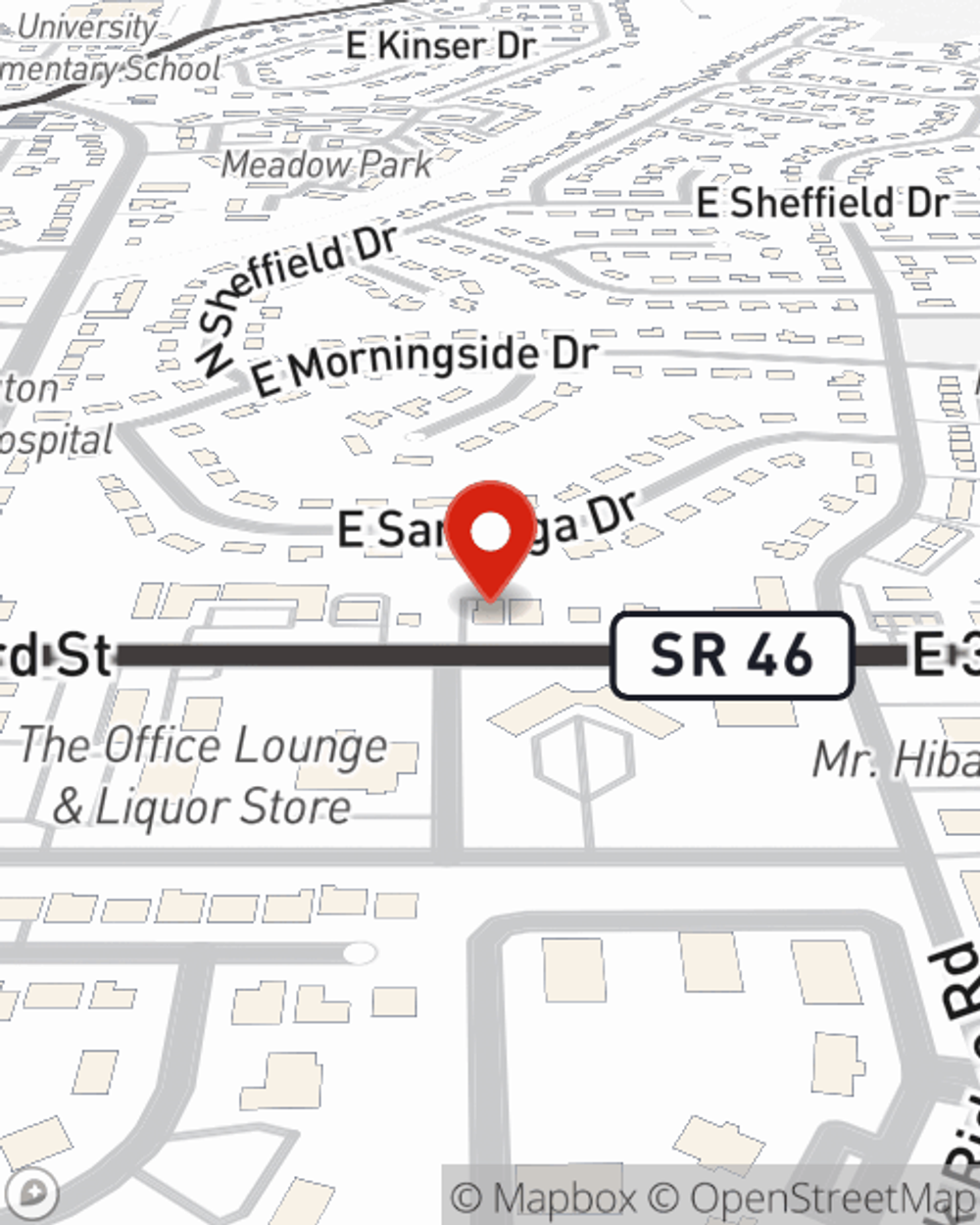

Homeowners Insurance in and around Bloomington

If walls could talk, Bloomington, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

- Ellettsville

- Greene County

- Indiana University

- Brown County

- Fishers

- Bedford

- Martinsville

- Nashville

- Bloomington

There’s No Place Like Home

One of the most important steps you can take for your loved ones is to cover your home through State Farm. This way you can take it easy knowing that your home is taken care of.

If walls could talk, Bloomington, they would tell you to get State Farm's homeowners insurance.

Apply for homeowners insurance with State Farm

Open The Door To The Right Homeowners Insurance For You

From your home to your beloved hobbies, State Farm has insurance coverage that will keep your valuables secure. Lindsay Schnarr would love to help you know what insurance fits your needs.

Don’t let worries about your home keep you up at night! Reach out to State Farm Agent Lindsay Schnarr today and find out how you can benefit from State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Lindsay at (812) 332-FARM or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.

Lindsay Schnarr

State Farm® Insurance AgentSimple Insights®

What to do after a wildfire

What to do after a wildfire

The aftermath of a wildfire can feel overwhelming. When you get the all-clear to return home, know where to start and how to stay safe as you recover.