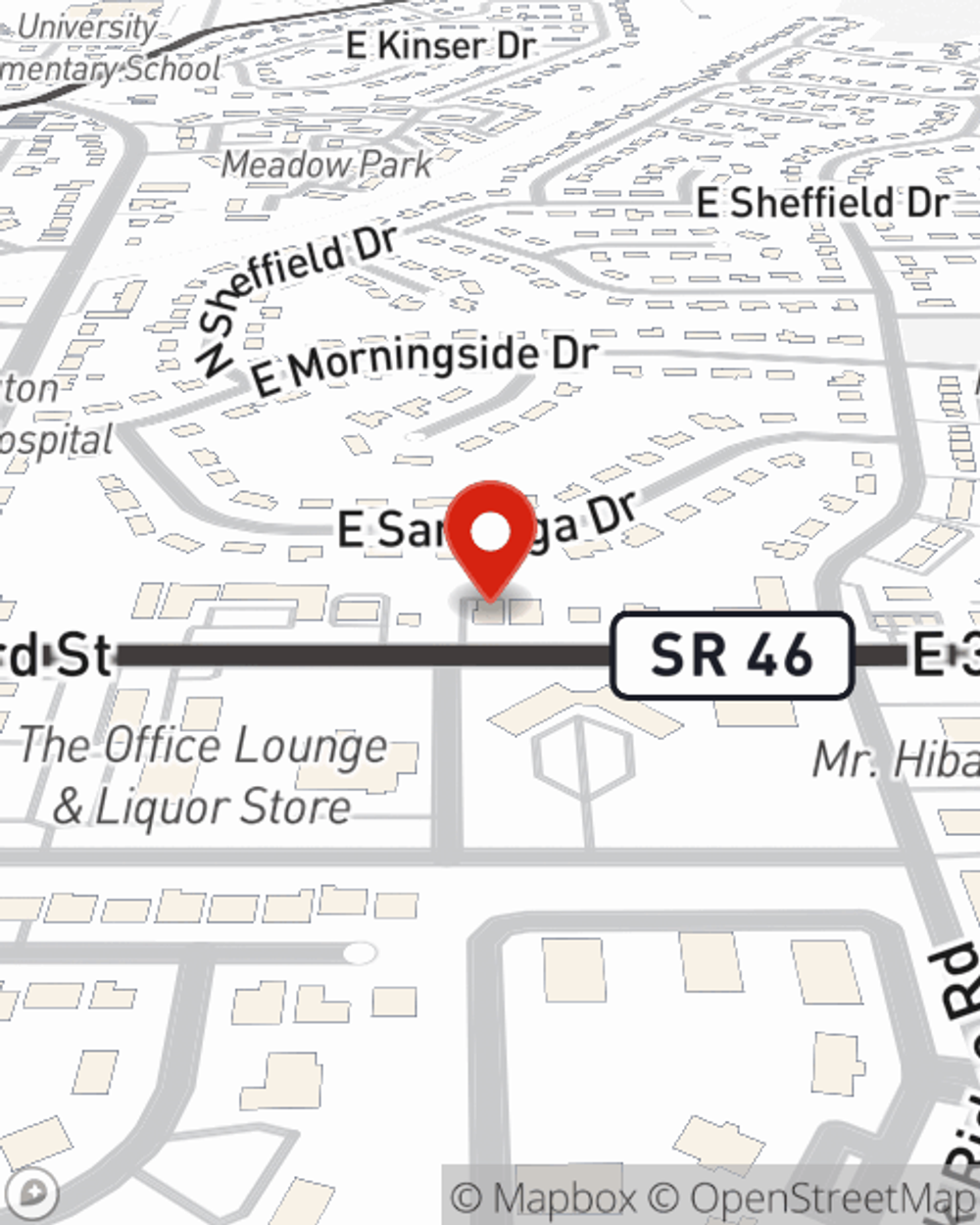

Life Insurance in and around Bloomington

Get insured for what matters to you

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Ellettsville

- Greene County

- Indiana University

- Brown County

- Fishers

- Bedford

- Martinsville

- Nashville

- Bloomington

State Farm Offers Life Insurance Options, Too

One of the greatest ways you can protect the people you're closest to is by taking the steps to be prepared. As pained as considering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Get insured for what matters to you

Now is the right time to think about life insurance

Life Insurance You Can Trust

Having the right life insurance coverage can help loss be a bit less debilitating for your partner and allow time to grieve. It can also help cover important living expenses like ongoing expenses, retirement contributions and car payments.

Don’t let the unexpected about your future stress you out. Contact State Farm Agent Lindsay Schnarr today and explore the advantages of State Farm life insurance.

Have More Questions About Life Insurance?

Call Lindsay at (812) 332-FARM or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.

Lindsay Schnarr

State Farm® Insurance AgentSimple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

Do stay at home moms & dads need life insurance?

Do stay at home moms & dads need life insurance?

Even when an adult family member doesn’t work outside the home, life insurance is still worth considering.